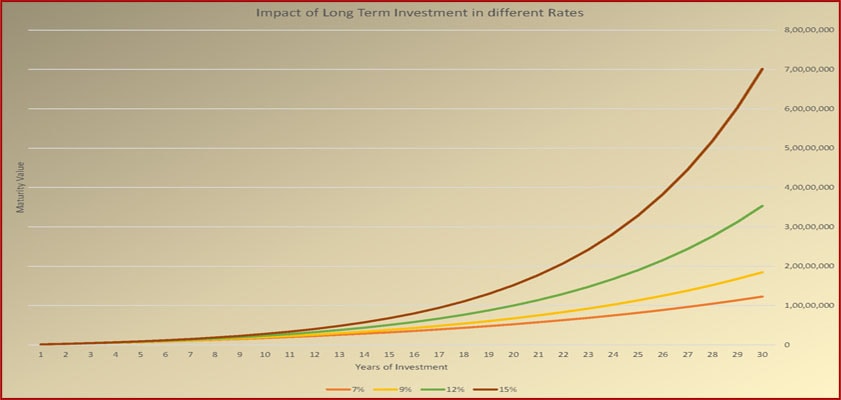

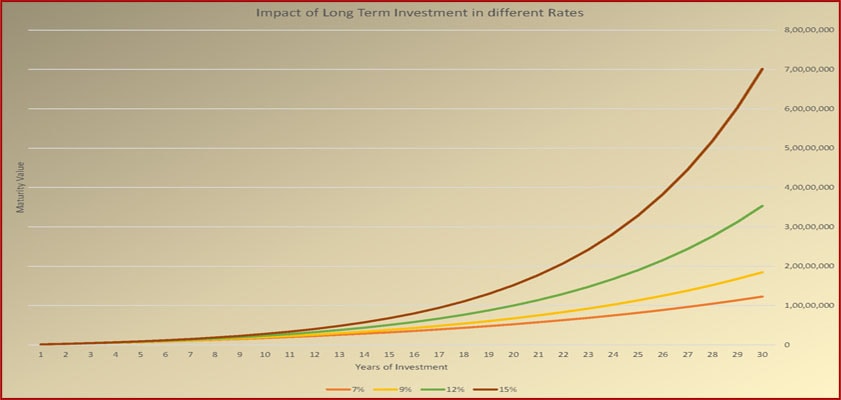

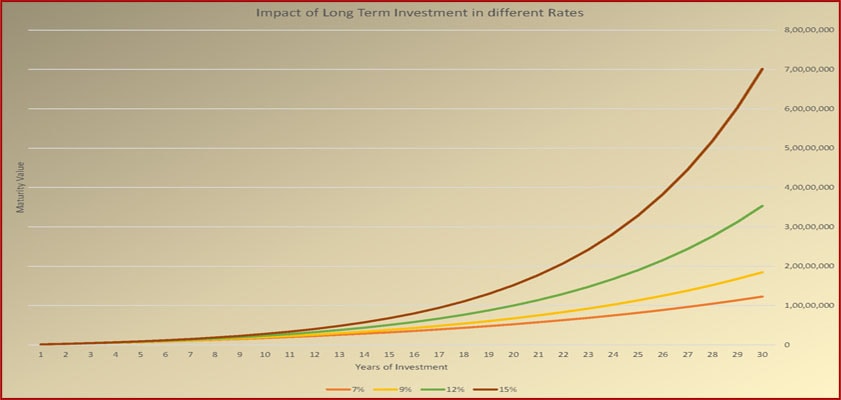

Most of us believe that by doing FD’s we are creating wealth. Let’s see how far it is true and also the effect of 7% vs. 15% in Long Term Investments.

For example, Mr. Banerjee is an orthodox person and he believes that doing FD is Wealth Creation.

He invested Rs. 1,00,000/- in State Bank of India’s Term Deposit;

Tenure of 30 years (by auto-renewal);

The average rate of interest considered 7% throughout the period.

Mr. Chatterjee, a friend of Mr. Banerjee, is a Moderate investor by nature. He invested an equal amount in a product which has the potential to generate around 15% CAGR return logically, in a market-linked product.

Mr. Chatterjee invested in Mutual Funds Rs. 1,00,000/-;

Tenure of 30 years;

The average rate of interest considered 15% CAGR over the period.

Let’s see where who is standing?

Maturity value of Mr. Banerjee is Rs. 1,22,70, 875/- and guess the maturity value of Mr. Chatterjee… what is hitting in your mind? it could be something around double, what Mr. Banerjee made..!!!??

You are wrong…!!!

The maturity value of Mr. Chatterjee would be around Rs. 7,00,98,206/-…!! Yes,… around 6 times, what Mr. Banerjee made.

This is the power of investing in a higher rate and obviously for the long term.

Address: B1 Mahesh Niwas, Road No. 3, LT Nagar, Goregaon West, Mumbai MH 400104

Address: Ganapati Bhavan 32 Ramlal Agarwala Lane, Sinthee Kolkata, West Bengal, India 700050