- March 25, 2022

- Admin Wiseinvestor

- 0

I have noticed that the most frequently asked questions about mutual fund is “What is the best mutual fund to invest in?” or “What is the best SIP?” etc., etc. Hope this is your mind also.

Let’s imagine, you are facing some health-related issues, e.g. headache. You visited the nearest pharmacy and asked the shopkeeper, to offer you a “good medicine”, remember only “Good Medicine”.

What the pharmacy will reply? Will he offer anything to you?

Definitely not…!!

The Pharmacy will ask you “What medicine you are looking for? What is the issue? What is your problem?”

Why did he ask so? Because there are thousands of medicine in the shop. Unless and until you explain your problem to him, he will not be able to offer the proper medicine to you. If he picks up any medicine randomly e.g. Sorbitrate Tablet, will it resolve your problem!!?

No, never…!!

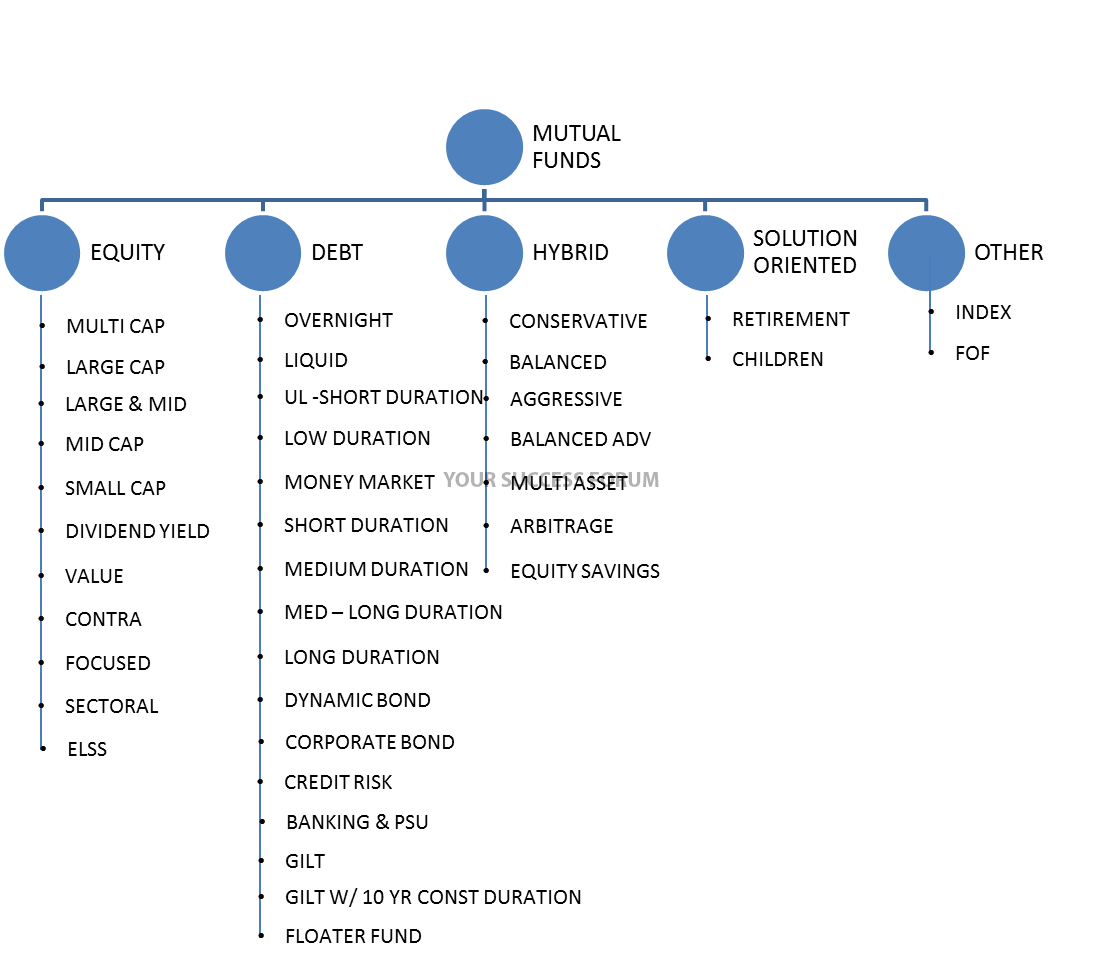

Similarly, in Mutual Fund, there are around 3 major and around 50+ sub-categories. There are around 2000+ mutual fund schemes available in the market.

Yes, friends, 50+ sub-categories and 2000+ mutual fund schemes and further each of them are different from others in terms of investment objectives, asset allocation etc.

Remember here, investment in a mutual fund is not like the purchase of groceries. Cholo dukan main gaya aur kharid liya…. No never.

Wealth creation through mutual fund Investment is a long time process (10 years and above). A wrong purchase or investment will impact you a lot, and you will not be able to undo it. Because TIME investment is more important than MONEY here.

Hence, whenever it is a matter of investment in a mutual fund, the scheme selection is a tinny part.

As per research report of S&P 76% of Indian adults do not adequately understand key financial concepts, including risk diversification, inflation and compounded interest. Analysing mutual fund schemes is far away.

As a Personal Finance Consultant, whenever we recommend any Mutual Fund Scheme to our clients, we follow a few steps:

Step 1: Need Analysis – It is a counselling process takes attest 2-3 hours.

Step 2: Risk Profiling to understand which types of investment products will be suitable for him or her

Step 3: Personality Test to understand his or her behavioural pattern,

Step 4: Goal planning or Financial Planning

Step 5: Working on Assets Allocation

Step 6: Deciding of Mutual Fund Scheme Category

Step 7: Deciding on Mutual Fund Schemes within the category

Step 8: Deciding on Investment Options

Note that, it is not the money or scheme, which will create wealth for you. It is your behaviour with money, which plays a key role in your wealth creation. Research has shown that allocation i.e. how much you put into equity, debt etc has a higher impact on returns than fund selection i.e. fund A or fund B. As an advisor cum coach, it is our prime responsibility to manage your behaviour with money, with respect to the dynamic socio-economic factor influencing you, so that you can create wealth over time.

In conclusion, there is no good or bad mutual fund scheme. You need to choose the right scheme as per your need. Never run behind rankings, NFO etc. Focus on your need, scheme objective and consistency. Unless and until, you have sound knowledge, understanding of macro & microeconomic factors, time to research and monitor your investment, don’t try to OPERATE your self. It is always recommendable to consult with a Certified Financial Planner before investing.